|

Looking for safe, consistent income when markets fall?

TheStreet's

DIVIDEND STOCK

Portfolio Manager

Shares His Secrets

|

|  | Are any companies increasing their dividends while the price of their stock is rising? (You'll learn about 11 of them below.)

|  |  | Are any companies likely to cut or eliminate cash payments to investors without notice? (You'll learn how to spot them a mile away in a moment.)

|  |  | Are ETFs a good way to diversify my dividends? (There's only one worth considering today and it's in our model portfolio.)

| |  |

| Fellow Investor,

My name is Dave Peltier. I'm TheStreet's dividend-stock portfolio manager.

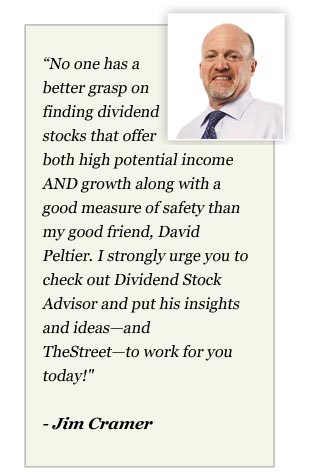

|  |  | Jim Cramer, founder of TheStreet and my boss, asked me to get in touch with you. And I'm glad he did.

Because if you're looking for income that never quits and paydays that keep getting bigger, or if you're more interested in reinvesting dividends to supercharge your total returns, then I have terrific news for you.

You've just been added to an elite group chosen for Charter Membership in an all-new advisory called Dividend Stock Advisor.

You've never seen an advisory quite like this one before. This is all new. Everything — all the recommendations, explanations and rationales — come directly to you not from an editor but from the actual portfolio manager who's pushing the buttons and making the investments. Nothing is lost in translation.

That's why Jim Cramer asked me to reach out to you... to make my research and recommendations directly available to you and a few other investors. Hence, the launching of Dividend Stock Advisor.

As for performance...

|  |  | I know editors love cherry picking from their track records to impress you. Good thing I'm not an editor. Besides, I figure you're a wise enough investor to sniff out hype a mile away, anyway.

So that you don't mistake my excitement for hype, I'll reveal all my open positions to you in a moment.

You'll see my best recommendations — and my worse. But first, I want to be sure you understand this is not a trading service. It's not a buy-and-hold service, either.

My only focus is dividend-paying stocks for your serious money... the money you'll rely on for the rest of your long, luxurious life... the money you must never leave vulnerable to fast-changing economies and trends.

History shows dividend stocks offer the best way to build long-term, lasting wealth. Some swear it's always been the only way to do it.

|  |  | What do the facts say?

| From 1871 to 2003, reinvested dividends accounted for an astounding 97% of the stock market's total return.

|  | From 2000 to 2010, dividends accounted for 87% of the S&P 500's total return.

|  | Today, dividend-paying stocks are hotter than ever.

| |  |  | These days, bonds are paying less than dividends. Income investors are scrambling. Corporations, meanwhile, are overflowing with cash — estimates are $1.7 trillion in cash — and folks in and approaching retirement are catching on to the idea of investing in stocks that pay them real cash just for owning them.

I've never seen the spotlight shining so brightly on dividend stocks before. And I'm worried for the average guy... mistakes are too darn easy to make.

Maybe not you, but I know most individual investors have it all wrong about dividend stocks. Some think companies pay cash dividends just to keep people from selling their stocks when the exciting growth days are done for these mature companies.

Other investors, mostly those looking for income, think finding the best dividend stocks is simply a matter of running a finger down a list, stopping at the highest yield, never stopping to realize...

Why the Pros Fear Eye-

Popping Dividend Yields

Seems contradictory, but the pros know super-huge dividend yields are likely a result of a drastically depressed share price, which in turn often signals a severe dividend cut, or worse, the elimination of all dividends.

It's funny... every so often I run into an investor who asks me the same thing:

I try hard not to roll my eyes when I answer so I keep it short... "You lose the tax advantages dividends give you and the share price will likely be lower than what you paid. Have a good day."

|  |  | The unique nuances of dividend stocks stump most investors. Evaluating payout ratios... historic rates of dividend increases... shifting economic trends... it's all so complex most individual investors on their own hardly ever reap the biggest rewards.

|  |  | Buy-and-hold is nice, but changes can come fast these days.

Fortunately for you, our team of top investment analysts here at TheStreet are using all the newest tools... and there's no question the latest software and computer magic helps keep us ahead of the dividend game. There's more.

Your edge sharpens when we step away from the computers

When we're away from the computers we're in direct contact with more movers and shakers in business, politics and the investment world than any other investment service can reach. The intelligence gathered is critical to our success.

Are you beginning to see why I believe you'll love belonging? If you're not sure you'd like to be a Charter Member of Dividend Stock Advisor, that's fine. You can make your final decision later. You have a more immediate decision to make...

|  |

Some companies are paying double, triple, even 10 times the yield of bonds, making this the Golden Age of Stock Dividends. But beware.

Those "generous" companies, more often than not, usually have no chance of maintaining those levels of investor payouts.

And when dividends are cut or eliminated, share prices suffer, too. You get whacked twice. You lose your income and your capital.

It's easy to fall victim. It's even easier for you to avoid this trap when you're getting Dividend Stock Advisor, TheStreet's new advisory.

| |  |  | Do You Want 2 or 4 FREE Bonus Gifts?

Your gifts are yours FREE immediately.

I'm so eager for you to experience Dividend Stock Advisor I'll give you all the gifts you PLUS -- 30 days to see if you like it. If you don't want to stay with us, you keep the gifts and pay nothing.

I'll return all your costs. Whether you lock in the special low rate for one or two years. You get every penny back. All your gifts, meanwhile, are yours to keep free no matter what. Fair enough? Then please act now!

These Gifts Are Reserved In Your Name

Two gifts are yours when you lock in our introductory rate for a year. All four gifts are yours when you lock in the special low rate for two years.

Here's a quick preview:

| FREE Charter Member Bonus Report #1:

Demystifying Dividends

If you're new to dividend stocks or even if you've been investing with them for years, the nuances can become complex. Wise investors evaluate the dividend yield, the payout ratio, the stock's price, and of course the company's outlook for the future before any buy or sell decision is made. Here, in this special report, the secrets of successful dividend investing are spelled out clearly. You'll learn the basics and then you'll go beyond the basics. You'll come across terms that may be foreign to you, but that's all right because this exclusive report gives you a glossary of terms every dividend investor must understand.

|  | FREE Charter Member Bonus Report #2:

Your Personal Dividend-Investing Tax Savings Guide

You invest to make more money than you have now. Just as basic is keeping more of that money away from taxes. This valuable report reveals some of my favorite, easy to use and perfectly legal strategies for minimizing your tax bill on dividend income. You'll still want to check with your accountant to be sure you're taking all the deductions and benefits available to you with dividend stocks. But first, get this report. It's FREE!

|  | FREE Charter Member Bonus Report #3:

How to Pick Dividend Stocks to Make the Most Money

As a professional Portfolio Manager with TheStreet, I pay close attention to risk as well as gains. As a member of Dividend Stock Advisor, you'll always get my best ideas. It's my job to help you reap rewards with as little risk as possible. My goal is realistic: 10% growth and a 3% to 4% yield every year. In this report, you'll learn some of my best, most successful, never before revealed dividend investing strategies that keep our wealth-building in high gear year after year.

|  | FREE Charter Member Bonus Report #4:

The Monthly Dividend Payout Predictor

When you buy a dividend stock can make all the difference. Buy at the right time and you won't miss a single payout. Otherwise, you might have to wait 3, 6 or even 12 months to get paid. As a member, you'll receive a new report every month showing you the dividend-paying stocks we like and their expected payout dates. You get this information in advance. This way, you're always ahead of the game and prepared to take full advantage.

| May I have your permission to release your free gifts to you?

They are yours FREE because I want nothing to stand between you and the wealth-building success you deserve. So I made sure no obstacles exist.

Granted, you'd be right to expect investors would pay small fortune for a private service like Dividend Stock Advisor. Charter Members, however, do not pay a high rate to belong. And neither will you. You're now eligible for a full year of continuous service for $49... yes, only $49.

Simply permit me to release your gifts to you. That's all you have to do to lock in the low Charter Rate. If I don't hear from you within the next 24 hours, your Charter Membership... the FREE Bonus Gifts... the special low rate of only $49 a year... all of it could go to someone else.

Don't let that happen. Respond right now!

Yours for greater returns,

David Peltier, Portfolio Manager

TheStreet's Dividend Stock Advisor

P.S. Your gifts are now reserved in your name, but I need your permission to release them to you. Don't wait a moment longer to respond.

|  | |

|  | |  |

Privacy Policy. Terms of Use.

To stop receiving any future marketing-related emails from TheStreet, please Unsubscribe.

This email was sent by: TheStreet, Inc.

14 Wall Street, 15th Floor New York, NY, 10005, USA

| RefUID:77024628

| |