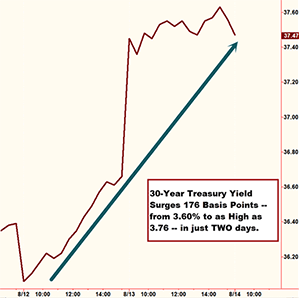

Dear Reader, In barely two days this past week, the yield on the US 30-year Treasury bond surged as much as 176 basis points, jumping from a low of 3.60% to as high as 3.76%.  That may not sound like a lot, but it's a 4.4% move higher in just two days. That may not sound like a lot, but it's a 4.4% move higher in just two days. To give it perspective, a 4.4% move higher would be as if the Dow Industrials soared roughly 686 points in just 48 hours. So it is indeed a huge move higher in rates. And we're worried, because as we've been telling you all along, the ENDGAME would see interest rates first explode higher in Europe ... then in Japan, which is precisely what's been happening there ... and then come home to roost in the USA. So the simple truth is this: The Federal Reserve is on the verge of losing control over interest rates. Rates could suddenly spurt higher again... and again-causing huge losses to investors in Treasuries and other instruments, and no matter what the Fed says or does. There are three steps you need to take immediately. We've laid them out for you in a letter that we believe can help you diversify your income portfolio. That's especially important right now, because it seems we are on the cusp of a substantial rise in interest rates, one that will change the game of investing especially for income investors. Take a look by click here. Best wishes, Mauldin Economics

Copyright 2013 Mauldin Economics http://www.mauldineconomics.com/opt-out |

No comments:

Post a Comment