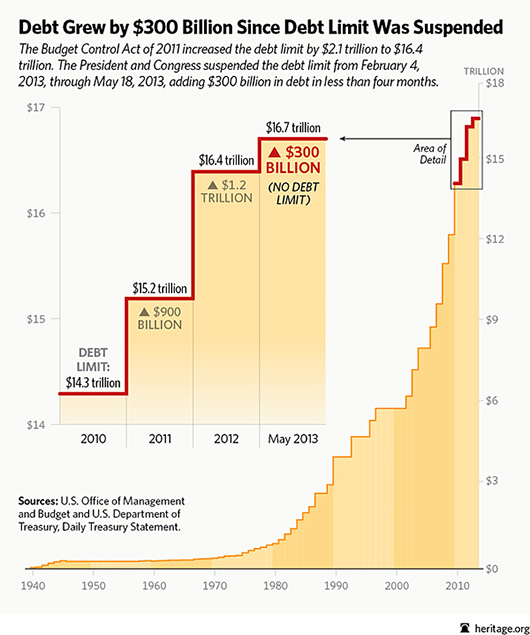

Dear Reader, Treasury Secretary Jack Lew sent a warning letter to Congressional leaders that the US Treasury will lose its ability to pay all of the government's bills in mid-October. "Operating the government with no borrowing authority, and with only the cash on hand on a given day, would place the U.S. in an unacceptable position," warned Lew.

That's one month earlier than expected and is because the national debt has increased by $300 billion from early February through May, despite previous budget cuts and sequesters.

Do you really expect the Republicans and Democrats to craft any type of agreement to raise the $16.7 trillion debt ceiling this time? Republicans want deep spending cuts in return for an increase to the debt ceiling. but President Obama was clear that he will not agree to any spending cuts. In the end, we're sure that at the eleventh hour, Congress will avoid a government shutdown and raise the debt ceiling. But what will that do to our credit? Will overseas creditors stand for it? Will rates continue to rise? We don't have all the answers. But we do know this: Investors looking for income need to readjust their strategies. Take a look at some solutions the team at Mauldin Economics has also come up with: click here now. Best wishes, Mauldin Economics

Copyright 2013 Mauldin Economics http://www.mauldineconomics.com/opt-out |

No comments:

Post a Comment